You may recall a few previous articles I've posted on the vultures out there that prey on your desperation.

Some of the most dangerous wolves of the pack are the investment newsletters, and there are thousands.

They are potentially very dangerous because they prey on your greed and desire for easy money. Meanwhile, they send you misleading claims if not outright lies.

Hopefully by now you realize that AVA Investment Analytics NOT INCLUDED in this huge group for obvious reasons (check the track record of AVA Investment Analytics chief, Mike Stathis as well as his credentials).

These are the same guys who rent or sell your email and mailing address to other companies, from credit cards and insurance to other newsletters.

They also bombard your mailbox daily; sometimes several times each day with bogus claims and scare tactics to get you to subscribe. They make you think you can easily become rich, if only you subscribe to their service.

Once you subscribe, they have you hooked like a fish. Then they offer you a buffet of other services. Before you know it, you're spending more money for these services and trading commissions than you've made in years. But that's a rarer outcome. Most end up losing money; sometimes a lot of money.

The problem is that for one reason or another, whether it's the huge minimums required from financial firms or bad experiences with them in the past, you find yourself on your own. And you certainly won't get a lick of real assistance from registered reps working for online brokers, because quite frankly these guys are morons.

So you find yourself all alone, faced with the daunting task of going up against the pros and winning. Despite what the TV commercials from online brokers tell you, the odds are stacked way against you. A few wise investors realize this, but many fall for these delusions. These are the people who learn the hard way trading on their own.

Some are seduced by the repetitive infomercials for trading services. I'll address these scam artists in the future. Here, I plan to focus on the newsletter guys.

To hook you, they send out emails and snail mail pieces claiming their trades made huge returns. I can guarantee you that these claims are always deceptive if not outright lies.

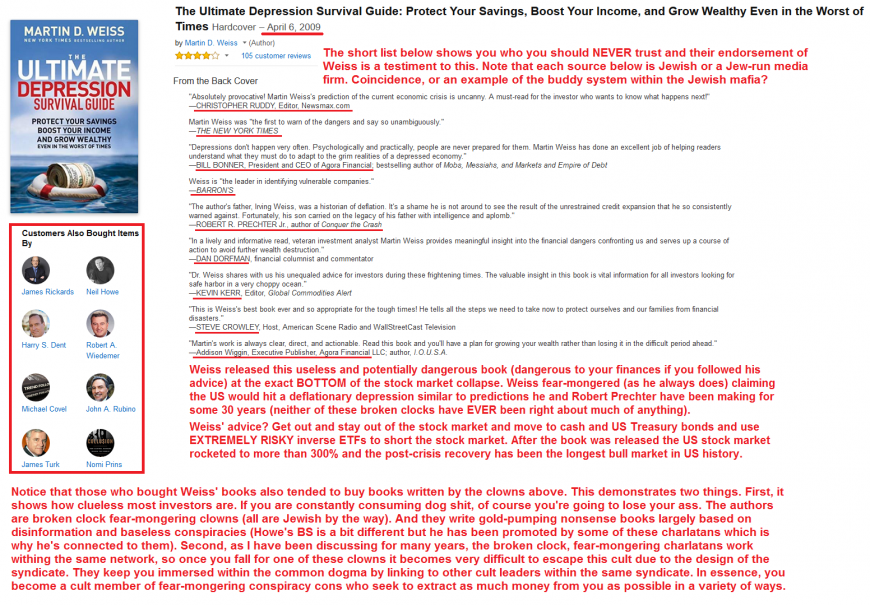

Let's take a look at a man you may have heard of. His name is Martin Weiss. He heads several online and print newsletter publications including the "Safe Money Report," "Money and Markets" and several others. He always refers to himself as "Dr. Martin Weiss."

This should be your first warning sign. Those who have a Ph.D.s should never refer to themselves as Dr. since it implies a medical doctor. When I see that, I always run. Has anyone ever heard of Dr. Phil? Yes, Dr. Phil the psychologist, not the medical doctor psychiatrist.

But then again, Dr. Seuss wasn't a real doctor now was he.

One might assume that "Dr." Weiss might have a Ph.D. in economics, business or finance. But that is not the case. His Ph.D. is in anthropology. Anthropology?? That seems odd. Now then, we ask whether he received any professional training from Wall Street?

Like virtually all of the thousands of other investment newsletter guys out there, as far as I been able to determine, the answer is NO. In fact, I'll bet on it. So then, where did he gain his "investment experience?"

Perhaps "Dr." Weiss gained his experience from day-trading in his mom's basement like so many others who claim to be experts? Well, maybe. But he loves sharing the legendary stories about his father. It's a shame I've never seen any verification about these stories that supposedly took place several decades ago. How convenient.

Now, in all fairness, a Ph.D. in business or economics certainly means nothing as far as credibility in the capital markets as far as I am concerned. Based upon the trash that has come from economists over the past few years, you probably agree.

What's really important is one’s track record. Once you examine "Dr." Weiss’ track record you can decide for yourself whether he is a "financial expert."

Weiss has a full staff of writers who spew out doom and gloom on a daily basis, flooding the Internet with the same message now for some 20 years. Therefore, the man has no credibility similar to Peter Schiff and the other perpetual doomers, because as we all know, it eventually rains in the desert.

Weiss likes to boast about many things as a way to establish credibility. I've seen in his marketing pieces where he claims of predicting the banking collapse..jpg)

In fact, I actually have a copy of his "Dangerous Banks" Report from 2001. It says the same thing he is claiming now. Most likely, he has been saying the same thing for 20 years.

“Like you, I’m supremely busy. I have my own analysis to do every day ... two companies with more than 200 employees to run ... and of course, all the writing I’m so passionate about.”

Yea you’re busy alright; busy designing deceptive marketing ads for your army of employees to plaster all over the Internet, luring in more sheep. After all, you gotta pay the bills at such a large operation.

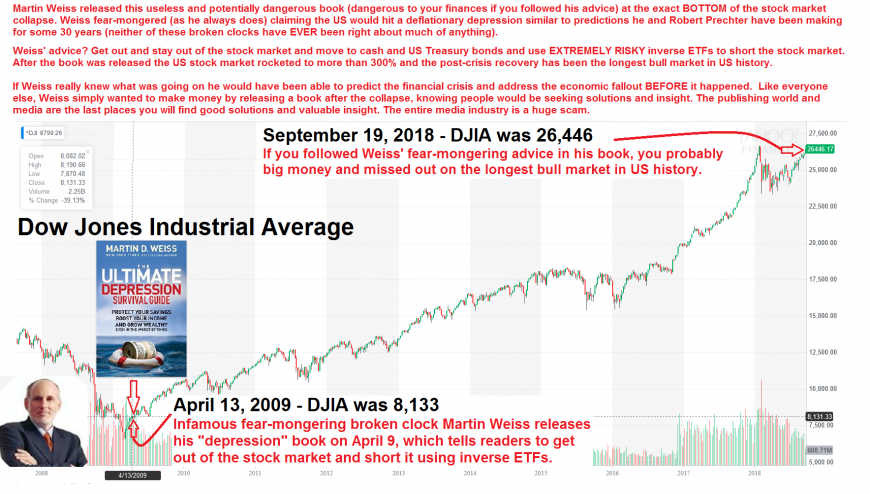

In April 2009, after the stock market collapsed many times reaching a low of 6500, Weiss released a book "The Ultimate Depression Guide." Just when it hit the shelves, the market was in the midst of a strong rally which stands at 30% today. Now that's what I call timing. "Dr." Weiss, where was your book BEFORE the collapse? Anyone can write one AFTERWARDS.

Based upon what I have observed, Weiss spent a huge sum of money to publicize his book, getting all of the media hacks involved. I read the book because I wanted to have proof of what I already knew. But that is by no means an endorsement. In my opinion, the book is garbage. It's a book for brainless fools. All he really does is tell you to buy U.S. Treasuries.

Oh and by the way, he offers you the chance to buy them from him. It's a great strategy to offer someone what are considered the safest investments in the world. But investors don't need to read a book to know to buy Treasuries.

In fact, if you want a conservative approach, you are better off in cash because treasuries have many risks, one being interest-rate risk, which could make them illiquid (unless you are willing to wait until they expire or you are willing to sell them at a loss). You really need to actively manage treasuries in the current atmosphere. And timing when to buy them is critical.

"Dr." Weiss' claims that he was the ONLY analyst to have predicted things. But where was his book prior to the collapse?

Let's face it. Weiss is no different than the other newsletter guys out there who use scare tactics and bogus claims to get you to pay ridiculous subscription fees for poor results. They also prey on your greed and desperation.

In fact, Weiss recently settled with the SEC for making bogus claims of performance while the actual results were much, much different. The SEC actually had several charges against him. Please have a look for yourself.

It appears as if the SEC forced Weiss to display results of his many trading services over the past year. After you see these results, you can imagine why he is desperate to come up with a radical marketing strategy.

As a way to silence his critics, Weiss and his clowns are offering subscribers access to a live trading account which shows you what he is buying and selling at an account held by Fidelity Investments.

The price?

Over $2000 annually. What a bargain!

After all, his previous services charged anywhere from $1000 to $5000 annually. The results of one of these services (randomly selected) are in a PDF attachment at the end of this article. You will be shocked when you see the performance.

As a part of this new strategy, Weiss has brought in a new guy named Claus. Apparently, Weiss realizes no one at his "200-employee" firm has a clue. Pay attention to how he glorifies things when pumping up his latest employee, Claus.

As you read this trash, notice the underlying messages - "it's so easy."

“In 1999, for instance, Claus accurately predicted the bear market of 2000-2003 that ultimately hammered the Nasdaq down 75% — and also decimated the Dow, the S&P 500 and nearly every other stock index worldwide.”

"Dr." Weiss, where is your proof? Show me where you said it in print. But also show me all of your print articles so you don’t cherry-pick only what you want us to see. See these newsletter guys write about every possibility-the market will go up, it will go down, etc. so they can pull out what they want later, claiming they predicted things!!!

“Plus, in late 2007, Claus’ stellar contrarian record earned him the privilege of being selected to manage a European ETF trading service ...”

This is simply too funny. “Privilege of being selected to manage an ETF service?” You have to be kidding me! Weiss wants to have you think that this is some major Wall Street job. Any moron can start an ETF service. In fact, all of these guys running ETF services are clowns in my book.

“And in 2008-09, Claus’ recommendations generated a tidy 28.2% overall gain, even while the S&P 500 plunged 44.9%, and the Dow fell 41.9%. (See chart and chart caption.)”

First of all, this is not true. If you read the caption from the chart, the returns were since inception which was in 2007. Second of all, consider that selected time period. In October of 2007 (when I told my clients to SHORT the banks) the Dow was at 14,200.

By the end of the reporting period for Mr. Genius Claus, the Dow had fallen by over 50%. So Claus actually performed pretty miserably for a contrarian. Any decent contrarian would have at least performed along with the downward sell off in the market.

What does this mean? Well, in my opinion, as a contrarian Claus stinks - unless you use Claus as a contrarian indicator! Think about it. Over the time he “managed” some online ETF service, we saw the biggest collapse of the stock market ever. So a good contrarian should have raked in huge gains. This was the best as it gets for contrarians, and Claus performed VERY poorly given the market decline.

Furthermore, after taxes and transaction fees, his net returns are probably around 15%, and that is if you even believe these returns. Until you see a third-party audited report, I wouldn't believe anything these guys say.

By the way, I would like to caution you about these ETF trading services. As previously mentioned, these guys are clowns and vultures. I'll address them in the future. Let's continue with Claus.....

“Until 2000, Claus advised high-net-worth investors for HSBC — the massive global bank.”

My Guess? Claus was a stock broker whose clients blew up when the dotcom bubble collapsed, forcing him to seek work elsewhere.

“But when the bank censored his warnings about the looming credit crisis, Claus resigned his prestigious, high-paying position with HSBC.”

"Prestigious?" I worked on Wall Street, and despite the perception, it's far from prestigious, unless you come from a chop shop or some cheesy newsletter service. As far as "high-paying," I'd really love to see evidence of this. Why would a guy leave a high-paying "prestigious" job to work with a guy who just settled with the SEC for millions of dollars? it’s based on opinion of what he said.

It's quite easy to make false statements or distort the truth, knowing that nothing they claim can be independently verified.

“Instead, he signed on with a smaller private bank that guaranteed his freedom to ‘call them like he sees them.”

What a joke. Like I said, I am willing to bet he blew up his book of clients and was forced to scale down to some rinky-dink firm, most likely a chop-shop. Why won't he name this "smaller bank?"

“Claus convinced the principals of his bank to sell all of their clients’ stock positions in 2007 ... and to use 10% of their money to buy contrarian investments that rise when stocks fall.”

Is that so? Perhaps he read my books then because let me tell you this. If he made that call, he would be heading that bank right now instead of working with some low-class vulture newsletter shop, selling doom and gloom.

And if 10% was all he recommended that in itself demonstrates he had no idea what was going on. If he had a clue he would have advised them to go to cash and wait until the full collapse.

Oh and what about his clients? Did he not convince them to sell? Sorry but none of this is adding up.

“And last year, the bank was richly rewarded for trusting Claus’ counsel: It became one of the very few financial institutions in the entire world that actually made good money for its clients.”

Really? Please tell me what “good money is.” Well if that is true then why do you refuse to name this mysterious bank?

Oh and by the way, it is illegal for banks or broker/dealers engaged in the securities business to post returns of its clients so how is it that you know they made “good money.” Hopefully, you can see how shady these claims are. Weiss provides no way to verify any of this trash. Trusting him is like handing your money to a stranger.

The list goes on and on….claims made with no proof.

Hopefully, you are able to see the potential for psychological manipulation and word twisting. Without any verifiable proof of these claims, I wouldn't believe a thing.

Update September 18, 2018: You might even want to spend some time reading the fake 5-star reviews on this dog shit book so you will understand that online reviews are fake and should never be relied upon. Don't you find it a bit strange how all of the fear-mongering idiots who released books at the bottom of the market crash warning you of more trouble ahead as well as other broken clocks who released books pumping gold while warning you to stay out of the US stock market have raving reviews despite the fact that if you had followed their recommendations you would be losing your ass majorly while having missed out on the longest bull market in U.S. history? It's called FAKE REVIEWS!

Weiss' new idea to provide real time (and advanced notice) access to a $1 million trading account is a clever marketing strategy because the sheep will say "well if he's willing to invest $1 million of his own money making the same trades he is providing to us, and in advance, well that's good enough for me."

But understand this, in my estimation, Weiss spends more than $1 milllion annually for marketing; perhaps much higher. His ads are scattered all over Google. It is nearly impossible to land on a financial website or even a website that has an article about the stock market and not see at least one of his ads. So this $1 million trading account is more of a marketing expense.

By the way, you might consider clicking a few of his ads when you see them to run up the costs of his marketing. This might encourage him to advertise less. In effect, you would be doing your part to help the sheep avoid his trash.

But also consider this. Weiss probably has over 10,000 subscribers based on research I have done. So, if he converts just 500 of them into his "Contrarian" subscription, he will cover this $1 million portfolio. The rest is gravy. And when you see the results of his previous year's trading services, you might imagine he will need as many subscribers he can get.

Now have a look at Weiss's own reported results of the past year's trading from his services. All I can say is WOW. You would have to try very hard to get such pathetic results!! (check the PDF attachment)

Weiss states that these results represent a compilation of client's brokerage statements that were sent to him. And I'm willing to bet he cherry-picked the best results he found, making his performance even more shocking. After seeing these results, it should be clear why he has decided to try a radically different approach.

Remember, it always rains in the desert; eventually. And if you have been predicting rain for 20 years, you've missed out on tremendous opportunities.

I’ll point out another trick. Notice how a subscription to this service also comes with several other benefits:

This other trash is added to keep you psychologically and emotionally connected to Weiss and his lynch men, so you will be forgiving when you get blasted by what is likely to be mediocre results at best.

I could pick this ad apart for a month and still not be finished.

I could go on about Weiss, but his deceitful tactics, exaggerated and often false claims would consume an entire book.

.jpg)

I don’t want you to think Weiss is the only one who engages in this type of business. All of these newsletter guys are the same, tempting you with bogus claims of huge profits.

One thing I’ve learned over the years is this. When you see that they are headquartered in south Florida (usually the West Palm Beach area) you should run like Hell. This area is infamous for being known as “Investment Scam Ally.”

But of course, there are many sheep that enable them to live and operate from one of the most expensive places in America.

The purpose of this piece was not intended to bash Dr. Weiss, but rather to show you how to critically analyze claims made by newsletters and other investment services. He just so happened to be most visible on my radar due to his massive marketing efforts.

Once again, there are thousands of other services out there that are as bad if not worse. Perhaps I’ll discuss the antics of another bozo in the future, Bernie Schaeffer from Schaeffer Investment Research. Hey, Wall Street claims to have credible research so why can’t guys like Bernie also make the same claims?

Weiss 12-Month Trading History of Premium Services

For the 12-month trading history, click on one or more of the publications listed here. To view the tables you must have Adobe Acrobat Reader.

UPDATED September 3, 2010. Weiss has made these performance records private, so these links no longer work. Fortunately, I saved the files which have been added below each link.

[Tables have been removed due to an threat by Weiss of a DMCA violation which constitutes an illegal use of DCMA]

The following link shows Weiss' trading history from 2006 through 2009.

If you are a Member or Client and you would like PDFs of Weiss' trading history since 2006, contact us.

After reading the endorsements for Martin Weiss you need to ask yourself this critical question...Can you ever trust endorsements again? It's not much different than onine reviews. Scams.

First, you should note how the endorsements are mainly from affiliated copywriting charlatans connected to Agora Financial. As well, you should note that Robery Prectcher has also endorsed Weiss the fraudster. Remember folks, you are judged by the company you keep!

Finally, note how Weiss used his Jewish connections as well as ad money he spends with mainstream publications (New York Times and Barron's) to land positive endorsements.

This is just one of thousands of pieces of evidence I have shown through the years pointing to the fact that you cannot and should not ever trust any media orgination because they are NOT on your side.

The following link shows Weiss' trading history from 2006 through 2009.

We suggest you save the images in the links above before Weiss and his monkeys have them removed.

You can also check for "Trading History" which should be located at the bottom of Martin Weiss' website.

The problem is that, being the sneaky slimey piece of trash that he is, he has specifically created several websites and only listed the Trading History link on one of them as a way to minimize his required transparency as set out by the SEC.

If you are a Member or Client and you would like PDFs of Weiss' trading history since 2006, contact us.

If you cannot find his Trading History easily by checking his website you should contact the SEC (help@sec.gov) and let them know.

You can download the SEC lawsuit against Martin Weiss, fellow Jewish shister Larry Edelson and their copywriting boiler room Weiss Research at the end of this article.

Additional publications from Weiss and his monkeys highlighting their various BS may be found in our Library which is reserved for Members and Clients.

Note to Weiss and his monkeys. It is against US law to misuse the DMCA as a weapon of intimidation. You know that your track record cannot be claimed under the DMCA especially since the SEC ordered you to publish it. It s public domain. Would you like the SEC to know you are making these illegal attempts to hide your trading history?

The fact is that you have hidden your track record because you know it is a complete disaster. We will be reposting your track record directly on our website and if you or any of your monkeys threaten us we will go to the SEC and inform them of your tactics. In addition, we may take further action as deemed necessary.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.